The financial system even today in most parts of the world is very unstable and unreliable.

The majority of a country’s workforce mostly in the underdeveloped and developing countries lies in the poorly educated section of the society. The GDP suffers a blow because the lack of formal education among the masses creates turbidity in the financial system as they fall prey to fraudulent systems.

True but unfortunate is the fact that most of the transactions happen in cash, which is an unreliable and inefficient mode of transaction. This is the reason why the entire nation suffers financially including the Government, the businesses of all scales, the senior citizens, the women, and every citizen in general.

All over the world especially most evidently in India in recent years, the Government has taken great initiatives to digitize the entire financial system for inclusive development in the nation’s economy and growth.

Businesses, though suffer due to a lack of transparency in the cash mode of transaction, and despite the awareness program by the Government, are skeptical of accepting digital payment and prefer the cash mode mainly because of the fear of losses.

However, the digital penetration is going to see a boom in the financial system and the businesses should see a surge in revenue if they adopt the system promptly mainly for transparency in the process. If you are managing an SME or a giant business or planning to do so or if you are a freelancer or a professional, you would surely like to know how digital payment can impact your business and how is the collection and tracking so immensely important.

What is Digital Payment Collection?

Digital payment is the process where payment is done online through any electronic mode of transfer.

Digital-payment over mobile phones, apps, debit, or credit cards, or online modes are highly beneficial to each individual participating in the economy and can be highly effective for a business to become profitable.

Digital Payment Methods –

- NEFT, RTGS, IMPS,

- Payment gateways,

- Point of Sale (POS),

- Mobile Wallets

- Debit and credit cards

- Online payment link

- A Neobanking platform with integrated ERP feature like Hylobiz

The digital payment process requires to follow basic security like confidentiality, authorization, and authentication.

Why is Digital Payment so important for your business?

If you are still hesitant to accept digital payment and is a fond user of cash, then the basic factors that should drive you to adopt the digital-payment mode is the transparency and efficiency in the system. The account maintenance becomes easy as a digital payment tool is low in cost, highly secured and fast and hence the revenue gets a boost. Several reasons why you should accept digital payment in your business can be summed up as under-

- High level of customer satisfaction and loyalty base can be achieved through invoice management and easy payment process.

- Can reach more customers within the country and globally as increasing number of individuals prefer online payments.

- Wider growth opportunity with growing number of smart phone users as payment, and other transactions through mobile in apps and web apps has become very common giving a wider digital reach.

- The operational costs of business reduce as the accounting process simplifies and the cost for additional bank charges and set up costs reduces.

- The high security, efficiency and high speed of transaction achieved by adopting digital payment mode gives high revenue to the business and promotes the growth of economy in an inclusive system.

- Keep a track of the payments made by you or the collections done by you or your colleagues in your business to have a strong accounting system.

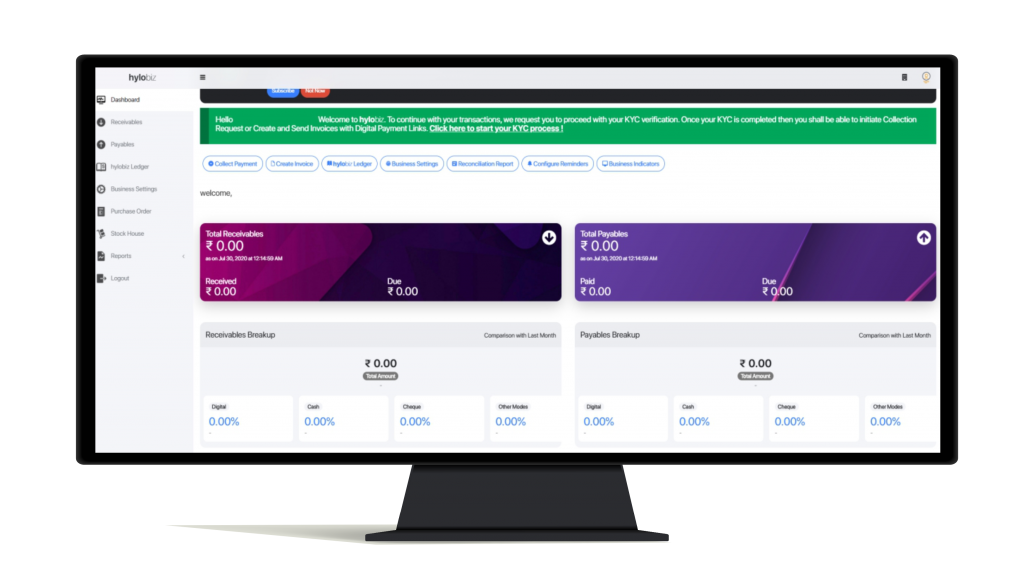

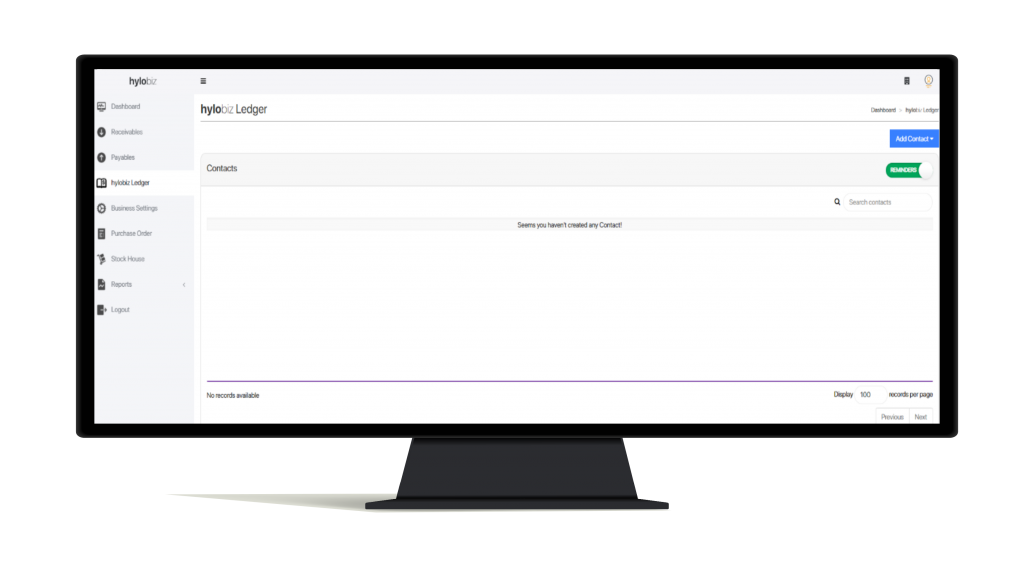

An integrated and connected system of Hylobiz that keeps track of invoices, receivables and payables, and payments collected can help you better manage your accounts to earn more revenue in a distributed system of ledgers.

Digital Payment Collection and Tracking – Role of Hylobiz in the growth of your business revenue

In India, since demonetization, with Government initiatives the use of digital platform for payment of money has taken a steep growth.

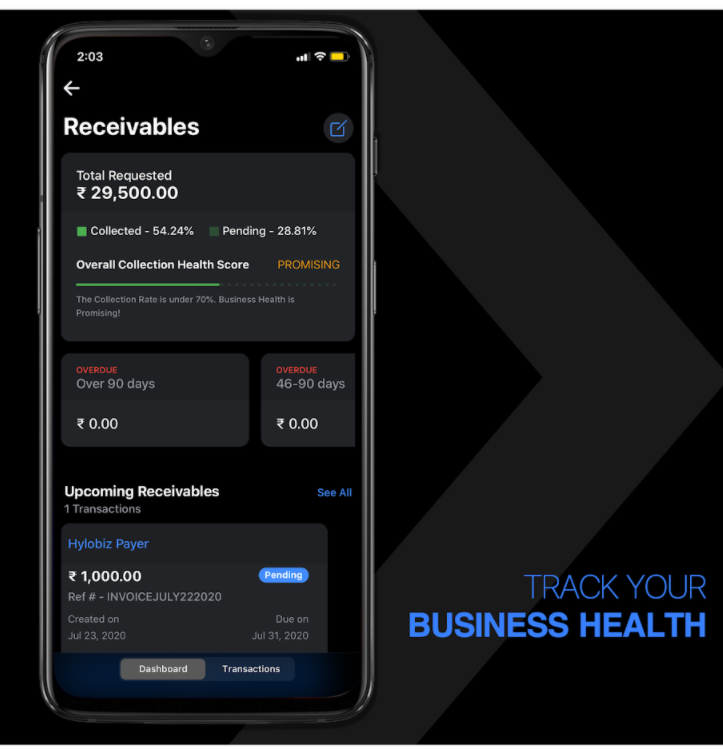

Earlier it was sometimes very difficult to track the amounts collected and to track the responsible staff for the purpose. There was huge difficulty to even get a clear picture of the balance to be collected or to be paid and the debtor or the creditor connected with such collections or payments would suffer.

Even today, Mr Javed, an SME business owner recently shared that the relation with a loyal customer got spoilt on account of amount of due wrongly demanded in absence of a system that can track the receivables and payables efficiently.

In another case, a sad incident of employee attrition happened just because the cash collected by a staff was mishandled and another staff was blamed for no reason.

There are instances where we have learnt that absence of an integrated system has caused troubles in businesses due to mismanagement of Account specially in –

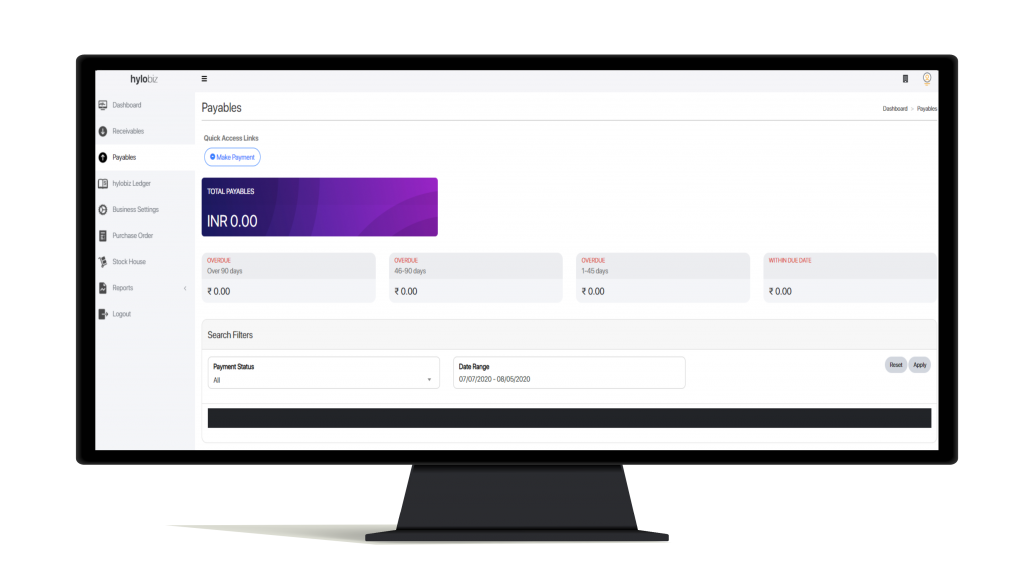

- payables and receivables,

- reconciliation,

- cash collection and tracking,

- payments,

- and settlement.

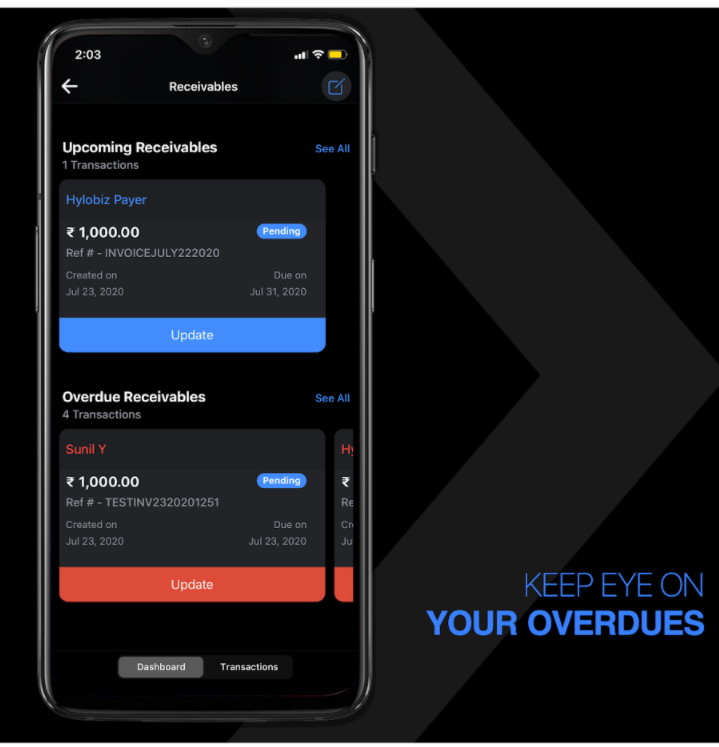

Hylobiz as your payment and invoice management partner can support you immensely in effective management of your Account and thus helping you handle your business with informed decisions on all the above areas. The secured online platform helps you digitally to track every bit of your income and expenses and can help you run a healthy business. The receivables and payables are tracked, and the staffs of your organization may be assigned a task based on their role through a connected system and their actions can be tracked easily.

Hylobiz platform can help you with digital-payment collection and tracking and help boost your business because of the following-

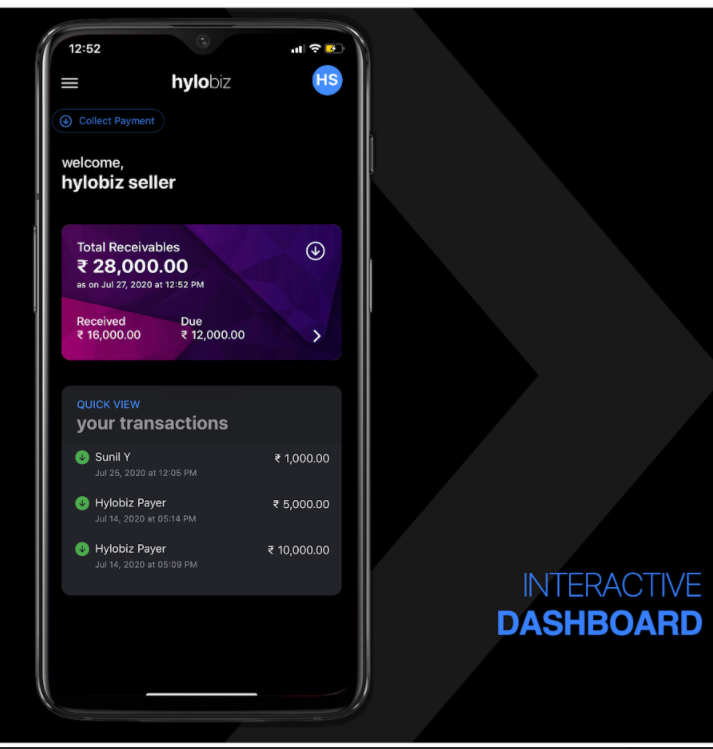

- The integrated ERP and dashboard reporting give a clear picture of the account payables and receivables and the balance helping in the collection process. The dashboard reporting depicts the overall business health.

- The Neobanking platform help pay out of taxes and other liabilities and in the bill discounting process.

- Hylobiz customers can make online payments and transact with other Hylobiz customers and may add beneficiaries and pay to non Hylobiz customers.

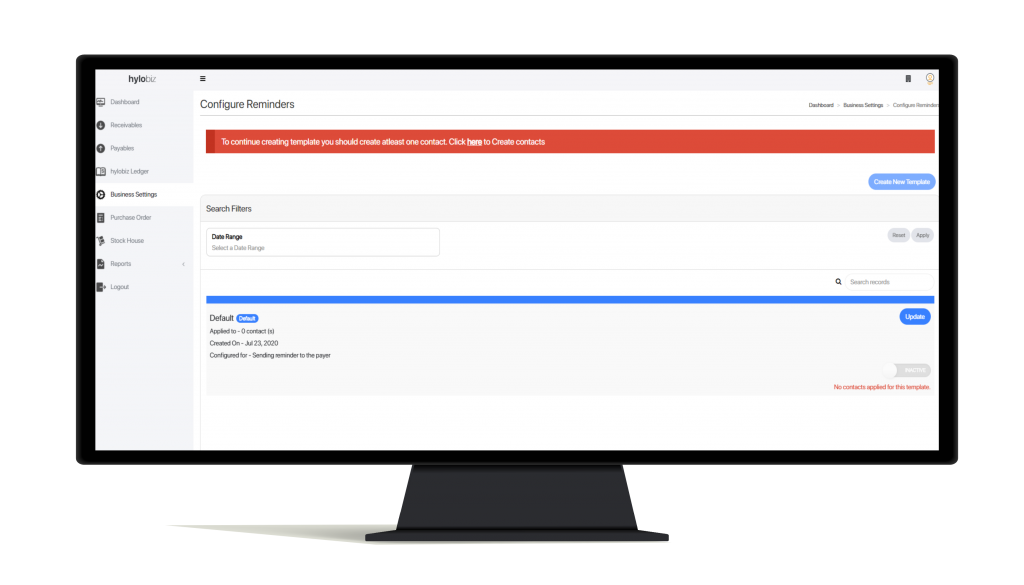

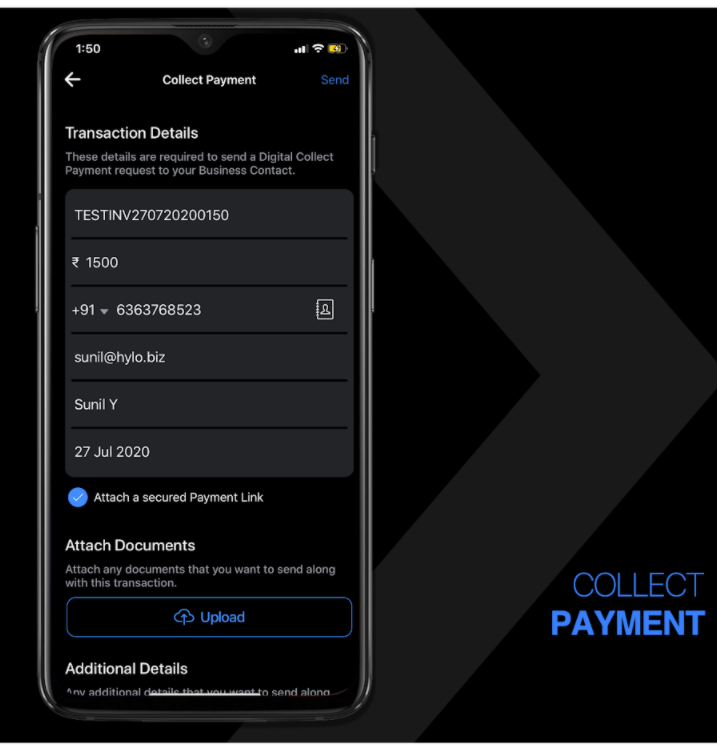

- The automated reminders help collections faster and easier.

- The distributed system of ledger can help you better manage your Account and can help earn more profits.

- The email or SMS service helps in efficient communication and helps prompt collection.

- The Hylobiz sellers can attach a digital-payments link of invoices.

- We provide you a connected system where the work of each employee and access to data may be restricted based on his/ her role. The well tracked accounts receivable and payable can help the designated staff collect the dues promptly or pay out the liabilities on time thus earning good gains.

The digital-payment collection and tracking will support building good relation with customers and positively keep your business healthy with a wider customer base and earn you good revenue as you neither suffer a bad debt situation nor come into conflict with customers ever in future.

We would love to help you grow a profitable business and would enjoy seeing you register on https://hylo.biz/neobank/Register

You may download and use our Mobile App for easy access to your Account.

https://play.google.com/store/apps/details?id=com.hylobiz.biz&hl=en

For more details please contact us at support@hylo.biz