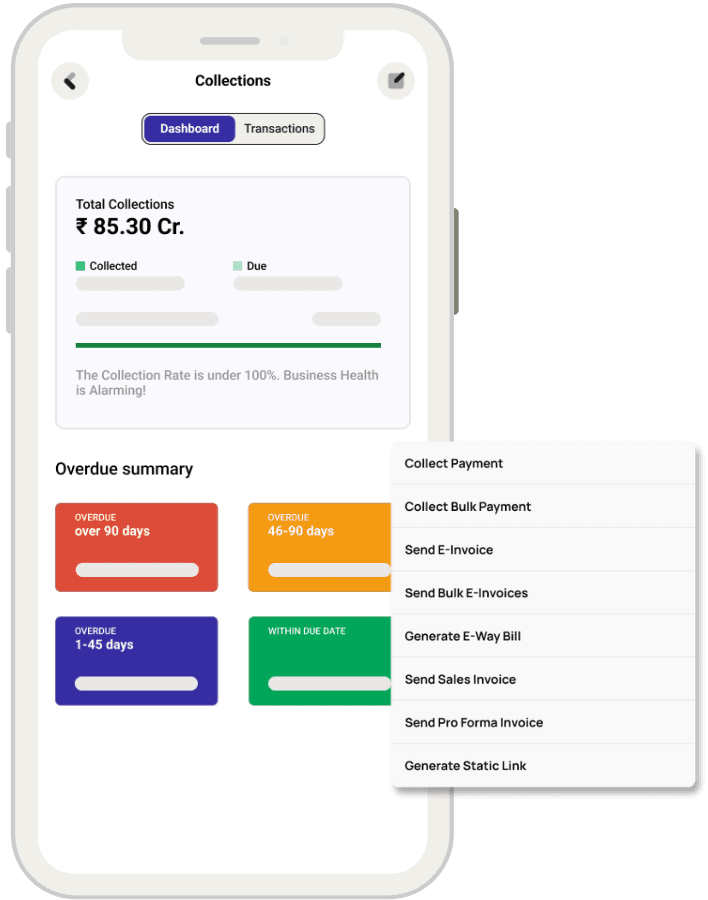

An automated solution like Hylobiz can give access to increased efficiency, faster payment processing, improved accuracy, cost savings, and enhanced security. By automating invoicing tasks and streamlining payment processing, you can save time and money while reducing errors and cost and improving security.