ERP and bank account integration

Do you often miss out on your invoice collections?

Do you often find it difficult to manage business growth and remain competitive?

If the answers to the above questions are yes, then you definitely need to consider Hylobiz!!!

In today’s connected world, where businesses are growing exponentially at the speed of light, the success of every organization depends upon its ability to respond to a fast-changing environment while taking quick and effective business decisions.

Have you ever considered the chaos and impact of irregular manual invoices and tracking on your business functions, difficulties in coping with delayed collections and manual reconciliations?

Horrible, right?

What if we say, that your existing ERP can be integrated with Hylobiz and all the business processes can be automated to get the organisation working as a whole like a connected neuro system of a human body?

Hylobiz: An Innovative Fintech Solution Streamlining B2B Operations with ERP and Bank Integration

Hylobiz allows small businesses to integrate their accounting systems. It acts as a bridge to connect business processes and reduces manual efforts to almost Nil. It syncs invoices, fast tracks collections and automated reconciliations on different devices and platforms through account integration and single sign-on, making reconciliations super easy.

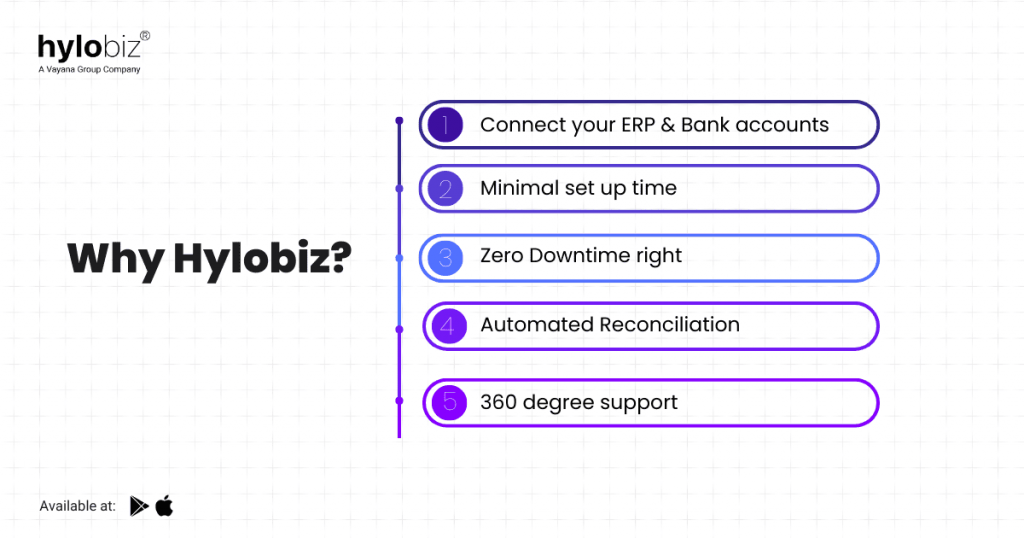

Why should B2B Businesses Opt for Hylobiz?

- Connect your ERP and bank accounts:

Without any process changes, you can quickly connect your current ERP to Hylobiz and automate invoicing and collections for your business. Invoices can be easily sent and paid more quickly with automated payment links. - Minimal setup time:

With ERP connected, you can quickly and easily upload your data, work on it, and securely integrate all of your information into your systems. - No unplanned downtime

Hylobiz understands your organizational requirements and works hard to ensure that our systems are always available to you. - Automated Reconciliation:

Use a digital ledger to track your transactions in real-time. Automatic reconciliation reports are also accessible anytime and anywhere, saving you time and effort. - 360 Degree Support:

Get 24-hour technical support from Hylobiz’s team.

Map your Business Processes in One Platform!!

It is easy to connect any ERP like Quickbooks, Zoho, Tally and Inventory with the Hylobiz platform. Organizations can easily integrate these applications into the hylobiz app once they have a subscription, hence saving cost and separate efforts.

Businesses can integrate their ERP and bank account with ZERO PROCESS CHANGE and get access to automated business processes through Hylobiz which means that businesses can continue working with their regular processes and there is no need to ever change their structure while being connected with Hylobiz.

Benefits of ERP and Bank Account Integration with Hylobiz:

- Auto sync of invoices.

- Easy generation of e-invoices from digital invoices.

- Faster collections with payment links and automated reminders.

- Automated reconciliations.

- Automated payouts.

- Real-Time tracking of unpaid invoices and cash flow with dashboards and automated reports.

- Easy access to working capital loans from any financial institution.

Hylobiz supports business scale by providing faster collection time, greater cash flow, and easier access to working capital, e-invoicing, and e-way bills. They offer easy inventory management, smooth ERP connectivity and a full suite of cash management services, including the ability to exchange invoices and collect payments on time by sharing payment links with customers and setting up payment reminders, and customizable automated payment tracking.

The smart dashboard and automated reports can be accessed with web apps and mobile devices to keep you updated about real-time cash flow and unpaid invoices which supports decision-making and easier access to working capital. You have round-the-clock access to your business information using the web app and mobile devices.

The Advantages of Adopting Digital Automation with Hylobiz

- Digitization of Invoices

- Reduction in Invoice collection cycle time

- Improved Cash Flows

- Better Customer Satisfaction

- Organized businesses processes

- Increased Flexibility

- Controlled expenses

- Informed decision making

- Better business planning

Hylobiz is a highly secure platform with ISO certification and bank-grade security. They protect your data and transactions by applying multiple encryptions and two-factor authentication.

So, what are you waiting for?

Fast-track your collections and automate your business process with easy ERP integration. Try Hylobiz!!!

Contact the Hylobiz team to know more, Book demo now

Reach out to us at: support@hylobiz.com

Suggested read: https://hylo.biz/how-connected-erp-and-connected-banking-can-improve-sme-payments-and-collections/

Frequently Asked Questions

Why is ERP important for Bank Account Integration?

ERP is important for Bank Account Integration as it allows seamless integration of financial data from multiple bank accounts into a centralized system, enabling real-time visibility and accurate tracking of financial transactions. This integration ensures efficient financial management, reduces manual data entry errors, and allows for timely decision-making based on current financial data.

What is Banking Integration or bank account integration?

Banking integration, commonly referred to as bank account integration, is the process of integrating a bank’s financial systems or services with external systems such as an organization’s ERP or accounting software. It facilitates the automatic transmission of financial data between the bank and the integrated system, such as transactions, balances, and statements, speeding up financial management operations and improving data accuracy.

How to improve my cashflow with ERP and Banking integration?

To improve cash flow with ERP and banking integration, you can use the capabilities of the integrated system to automate and streamline financial processes such as invoicing, payment reconciliation, and cash management. By automating cash flow forecasting, and facilitating timely payment processing, you can optimize cash flow management, minimize delays, and make informed decisions to improve your overall cash flow.

what is an integrated banking system?

An integrated banking system is a complete financial system that integrates numerous banking capabilities and services into a unified platform, allowing for seamless operations, data interchange, and client experiences across various banking channels.