Every business requires efficient financial management to maintain operational efficiency to run smoothly. Financial mismanagement may create havoc and ultimately may be a reason for a company’s sudden downfall.

The earnings and profitability of a business depend on what the company owes, and what it owns. The working capital of your business can speak a lot about the day-to-day health of your business.

You, being a professional, freelancer, an SME, MSME, enterprise, or corporate house may know the importance of working capital, but how can one ensure it is efficient i.e. Payments on time, Reducing expenses with adopting digital channels, tracking your inventory, customizing your business, a clear view of your payables and receivables and a lot more features could help you in working capital management.

What is working capital and how is it important for your business?

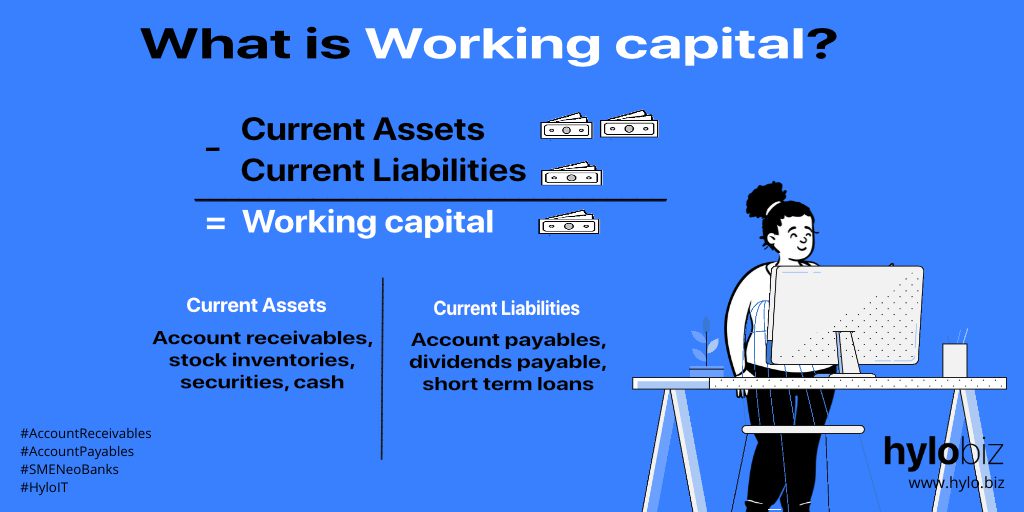

Working capital is the balance between current assets and current liabilities.

It is a ratio also known as the current ratio, which is a ratio obtained by dividing current assets by current liabilities.

Current Assets- Those assets that are generally expected to turn into cash within a period of 12 months are referred to as current assets. Account receivables, stock inventories, securities, cash, and so on are included in current assets.

Current Liabilities- The obligations that a company has and is liable to pay within a period of one year to the creditors are termed current liabilities. Accounts payable, dividends payable and short-term loans are some of the current assets that a company needs to consider in business.

How to manage working capital efficiently?

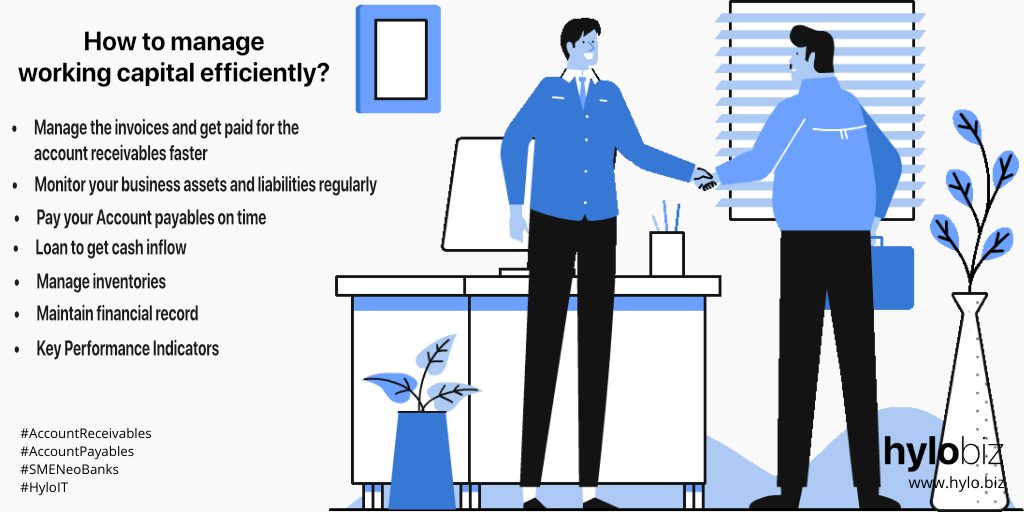

Now that you understand, that it is important to maintain healthy working capital in the business, let us give you a few ways how you can manage to do so. The following techniques if effectively followed will give you better business profitability and improve the working capital.

- Pay your Account payables on time- If you pay out your liabilities, then the business will be free from dues and will get into good deals and develop a better relationship with the suppliers or the creditors.

- Monitor your business assets and liabilities regularly- A good budget can reduce expenses, and this can be achieved by monitoring the current assets and liabilities.

- Manage the invoices and get paid for the account receivables – The invoices can be managed efficiently by outsourcing the responsibility to any finance company or by offering discounts to get cash immediately.

- Loan to get cash inflow- Loan against fixed assets like plants and machinery or any form of short-term business loans from Banks or NBFCs can help cash inflow to the business on an emergency basis.

- Manage inventories- Avoid excess stock and manage to purchase inventories keeping demand and supply in view to avoid waste of cash and avoid high maintenance costs.

- Maintain financial record- Recording even minor expenses and income help to maintain finances efficiently. The financial statements can help businesses understand their working capital.

- Key Performance Indicators -KPIs in each department of a business can help managers and employees align themselves to the business goals and feel responsible resulting in avoidance of over expenses. Hence a good flow of funds exists in the business.

How Hylobiz can help you manage working capital easily?

Hey, we would like to connect you with the business story of Mr. Yash, a freelance photographer, for instance, to best understand how Hylobiz can help manage your working capital.

Being a solopreneur after managing with regular work and social networking, Yash tries to save some time each day for database maintenance, marketing, planning, and scheduling. To run smoothly he needs to take care of taxes, and legal matters and above all requires a steady flow of funds to his business to deal with the expenses, liabilities, and operation costs day in and day out.

He has tried out multiple platforms like payment gateways, net banking, database management software, supply chain ERPs, social media, and communication channels for business and Accounting processes.

He has struggled to manage his Account, especially the management of –

- payables and receivables,

- reconciliation,

- cash collection,

- payments,

- and settlement.

Again, Mehtab, a small business owner in the paint industry also has a similar struggling experience with an additional need to record the cash collections by each employee.

The efficient and easy-to-use platform of Hylobiz with all the Accounting, data management, and communication solutions for smooth running of the business is of course the best catch for all such business scenarios.

If you are an SME business owner or a freelancer like Yash, you may have the sole responsibility and requirement to manage the financial system entirely without much support from an efficient Account professional. You will be highly satisfied when Hylobiz with an efficient system helps you manage your finances.

Being a professional, you and your organization may enjoy the connected system and based on your roles and KPIs will successfully be able to manage the working capital.

We can help you maintain your business’ working capital by effectively helping you manage your assets and liabilities in a distributed system of ledger with successful coordination with debtors and creditors which is possible because of the following-

- Integrating the ERP used in your business and the ERP used by every member at all levels in the supply chain seamlessly with the Hylo environment gives a clear picture of the account payables and receivables.

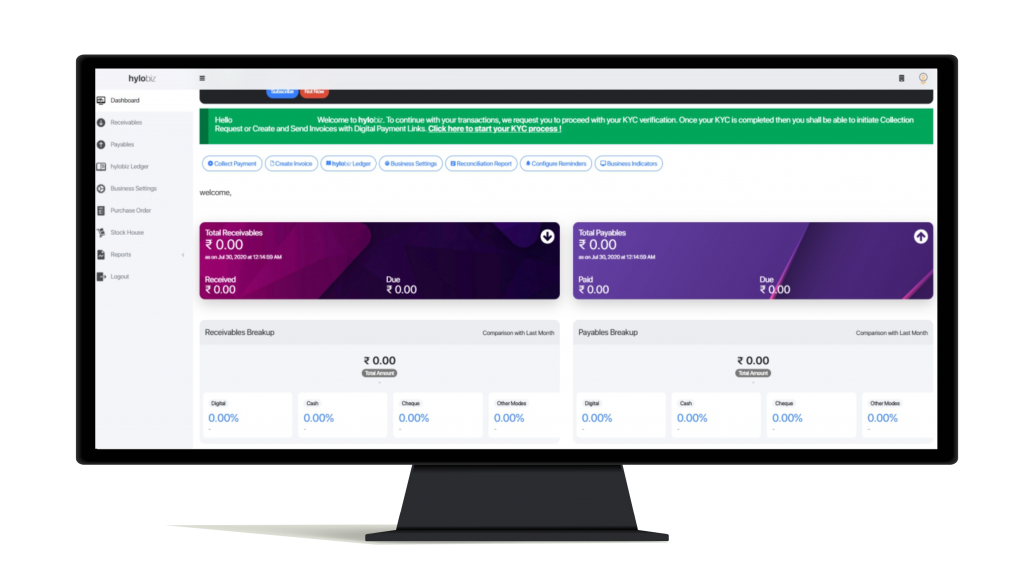

- The dashboard reporting helps in making informed business decisions.

When you register on https://hylo.biz/neobank/Register, you will be able to get a detailed report of the present status of Account Payables and Account Receivables.

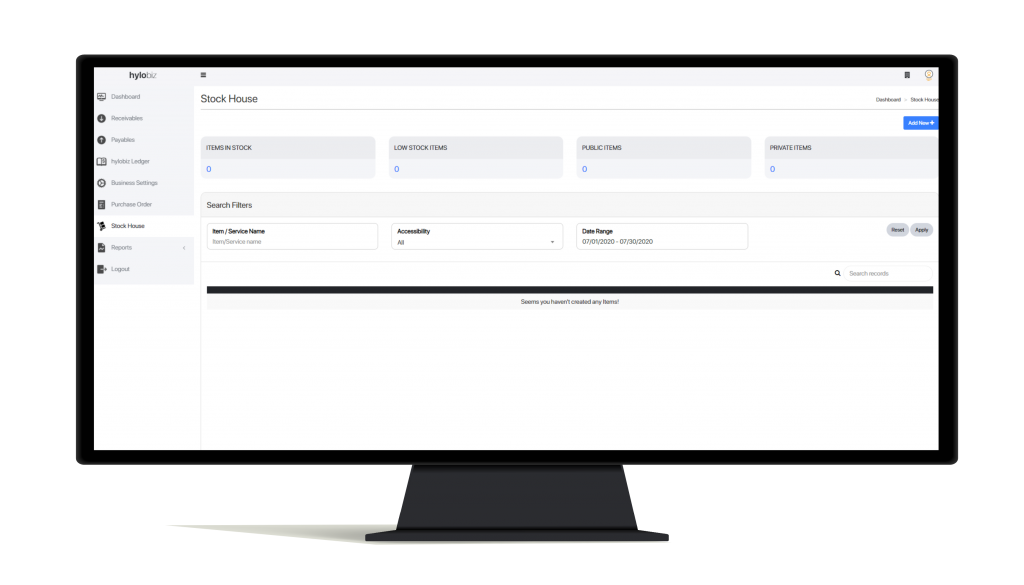

- The stock house and inventory listing help manage your inventories efficiently and in acquiring loans as well.

- The detailed record of Accounts and the automatic reminders helps collections faster and avoid bad debt through effective communication by email or SMS.

- The Neobanking platform will be effective to avail loans, bill discounting and tax payout easily.

If you feel interested to know more and get in touch with us, we are there to support you promptly. For further details please email us at support@hylo.biz