The economic tsunami unleashed by Covid-19 has created “new challenges” for the SME community. The effects seem endless with the whole value chain struggling to sustain itself amid the crisis. With so many business sectors severely challenged – the government is releasing support packages, banks are offering an extension of the EMI moratorium, and technology providers offering a month/two of free services.

The global pandemic has hit the RESET button in SMEs’ lives, we are witnessing a new way the work gets executed. There is a change in employer/employee relations and how the overall business ecosystem would look like.

While the pandemic may have brought down all your sales figures, profits, and revenues, don’t you think you learned a lesson – the best crisis management lesson. It’s time to wipe the slate clean restrategize, reconfigure, replan, retire and rescale to a newer growth of “new normal”. And Hylobiz can help you. Read on to find out -How?

Impact of Covid-19 on Small and Medium Enterprises

Restricting movement, and lockdown had resulted in a negative impact on businesses. Some of the key concerns faced by SMEs, solopreneurs, brands, and small businesses in India, UAE, and across the globe are –

- Sluggish growth in services, manufacturing, and agriculture sectors

- Increase in unemployment

- The decrease in government revenue

- Decline in exports

- Disruption in supply chains

- Facing Financial crunch

Road to Recovery for SME’s to the Next to Normal

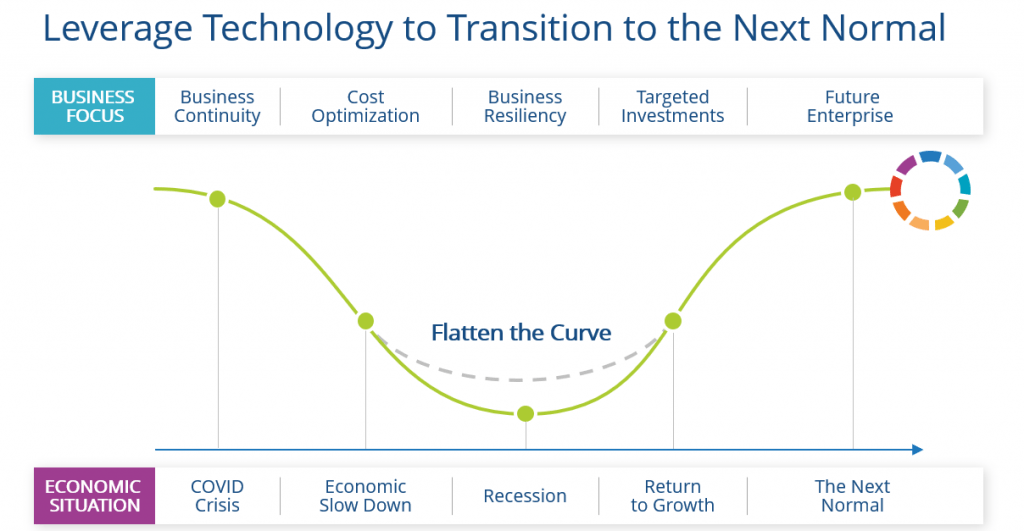

As per IDC, here are the five stages of how Small and Medium Enterprises can transition using technology to the next normal. The below row depicts the economic situation and the parallel row advises on what the business should focus on. So for example when COVID crisis is continuing, the business should look for measures to keep their BAU by maybe offering a solution at reduced cost or offering a 7-day trial or maybe including free shipping.

The depiction is a great way to structure your business in this challenging time. And we will see how Hylobiz can aid each of the stages.

How does Hylobiz support Small and Medium Enterprises in Business Continuity?

As the COVID crisis loomed in India, with sudden lockdown, and with each passing day there were new guidelines, businesses had a hard time keeping the business running. But one of our very first clients Ajay Nemani Cofounder of FF21 said – Our clients/people staying with us, almost 50% went to their hometown, so when it came to collecting this month’s rent, we were a little skeptical as would the payment be made? As we are using Hylo to collect our payments, we sent out the payment link and waited. By the 3rd and 4th of the month, the payments started flowing in. For a business like ours cash flow is very crucial and Hylo Digital payments, helped us collect the rent without any hassle.

How Hylobiz is Helping SMEs in Optimizing Cost

During the COVID crisis with “complete lockdown” all services, manufacturing, and jobs were completely stopped, it was a time when many the businesses might be at their peak like Food Delivery market was predicted to hit $8bn by 2020, but by the second week of March 2020, a 10 to 20 percent drop on food delivery as services has been reported and still continues. The Economic condition as reported by IDC was the COVID crisis, followed by the economic slowdown, and the focus of enterprises should be to optimize cost while keeping business as usual.

The very first thought on cost optimization is to “cut cost”, which I agree to cut-off unnecessary expenses, but moreover “improving quality” should be the first priority of cost optimization.

As a Small and Medium Enterprises, you might be involved in “Manual collection of payments” by sending a person and he collects the money. How often does it happen that two customers from the same location have their pending dues, and when the person goes to collect payments – one clears his dues and the other one says to come tomorrow/day after because of reasons like – couldn’t withdraw cash or had an emergency, etc. Now this “undue expense” and “mental stress” of making a phone call and confirming when to come could be hashed with Hylobiz.

Once an SME onboards their business on the Hylobiz platform, quick and friendly reminders with a payment link can be sent anytime to the customers. While the SME could leave his worry of following up manually, the customer could pay instantly via the Hylobiz platform.

Another way in which Hylobiz could help Small and Medium Enterprises in optimizing costs is – automatic reconciliation.

Let us pick an example, Aroma Sticks Pvt Ltd – an incense stick brand that uses accounting software Tally to manage their POs and invoices. While the distributors dealing with their sub-dealers uses Quick book or MS Dynamics CRM, so each day the distributors need to settle and reconcile the account in each of the ERP manually. A task that is prone to manual error and indeed mundane and time-consuming.

Hylobiz can easily pitch in here, integrate with multiple ERPs like QuickBooks, Tally, Zoho, etc, and at the end of the day send an updated status to each of the ERPs with reconciled data. This not only would help you in getting a clear view of the receivables and payables but would also assist in managing working capital efficiency.

Hylobiz, due to the COVID-19 pandemic is offering one month of free usage of the platform as well. If you are an SME, B2B, enterprise looking to digitize collections and reconciliations,

please contact us here.

How Hylobiz is Helping SMEs in making businesses resilient

Recovering from a downfall could only happen when payments are cleared on time, your sales representative can convert more leads and you can cut your unnecessary expenses.

During the COVID crisis businesses were shut, no money was flowing, no deals were honored and no trades were executed. With no clarity on when the payment dues would be paid, businesses were in bad shape. Although lockdown is open and things are returning back to normal, there is a hesitation in doing any physical transaction. The Collection guys going to collect money are at risk with the limited mode of commute and no clarity on which area he is traveling to.

Such scenarios could lead to further delays in payment collections and come as blockers to recovering from the downfall.

Hylobiz digital invoice payment collection links with T+1 settlement and customized email and SMS payment reminders can assist in collecting money faster.

With payments on time, as a business owner, you can focus on driving growth and planning for the future.

How Hylobiz has reduced payment delays, read our case study here.

How Hylobiz can support businesses in returning to growth

With our quick real-time views of receivables and payables on the Hylobiz Dashboard, SMEs can make targeted investments to return to growth. With transparency in inflow and outflow of liquidity, it gives an upper hand to enterprises to look for newer deals and make investments for future growth. By enabling money flow, and a clear understanding of cash flow forecasts businesses can segregate the necessary investment and ”good-to-have” investments for the near term.

How Hylobiz can help in making you a future enterprise

To be a future player, one needs to invest in the present and that’s what Hylobiz would assist you with. Offering end-to-end automation of the supply chain, once you have uploaded your invoice onto the accounting system, you can relax while customers make you instant payments and access a real-time view of payables and receivables in the dashboard.

You can adapt “new normal” by enabling “remote working” for all your employees. Bid goodbye to messy paperwork, audits, and cash transaction. Hylobiz can set your business from day 1 to a “new normal”. Its easy integration with legacy systems and simple workflow with minimal learning curve can help you and your employees to be productive in no time.

“Digital is the new calling” in the current situation. With lockdown we just saw a teaser of “Digital Transformation”, now with restrictions lifted up and push for New Normal, it’s time to adapt to a full digital transformation for your business growth and sustaining in the tough times.

And Hylobiz can help you at each step. To know more about it you can schedule a demo,

please contact us here.