Invoicing is a crucial part of any business transaction as it works as evidence between the buyer and supplier for the supply made. It contains details like quantities sold, date of shipment, prices, and discounts and ensures transparency.

Earlier it was easy for anyone to manipulate the invoices as the process was not transparent, which would lead to late collections and hurt the business growth.

To eliminate all these deficiencies from the system, the government of India has introduced e-invoice under GST for all B2B transactions made by a supplier.

After the launch of electronic invoices, it has eliminated the manipulation of invoices, data entry errors, or fake ITC claims from the system.

e Invoice under GST has smoothened the entire Invoicing process with increased collection efficiency, reducing operational costs, and improving the overall business.

Here in this blog, let us discuss the factors that lead to strengthening the future of a business with an e-Invoicing system.

- Promote standardization

The absence of a standard format for an invoice made it tough to understand.

Under GST, a uniform standard format applies to all businesses known as the ‘e-invoice schema’. - Automatic reporting

After an e-invoice generation, it is available to all the parties involved. It makes the process smoother and faster for businesses by reducing inventory handling time.

With e-invoicing, there is no need for multiple reporting in different formats. Also, e-way bill creation becomes easy by using auto-populated data of an e-invoice. - Eliminates fake invoices from the system

It allows the system to access the data in real-time, which helps the department to identify fake invoices. It will result in a reduction of frauds and fraudulent ITC claims. - Reduction in errors

With e invoicing, there will be no data entry errors as the same data will get reported to the buyer, supplier, and the tax department, which will also ease the reconciliation process. - Improved collections

With an e-invoice, you can improve your business collection efficiency by attaching your payment details with the invoice. Also, there is no physical movement involved in sending invoices, which ultimately reduces the receivables days and helps in generating healthy cash flows. - Boost invoice discounting

Electronic invoicing under GST opens the door to invoice discounting for businesses. As all the invoices under GST get automatically tracked and are accurate, the businesses can get easy access to capital through invoice discounting from banks/NBFCs.

Invoice discounting helps fuel their business growth by getting access to capital. - Improves overall business efficiency

With electronic invoicing, businesses enjoy reduced processing time and faster payment cycles that helps in saving cost and time, thus driving efficiency in the overall business.

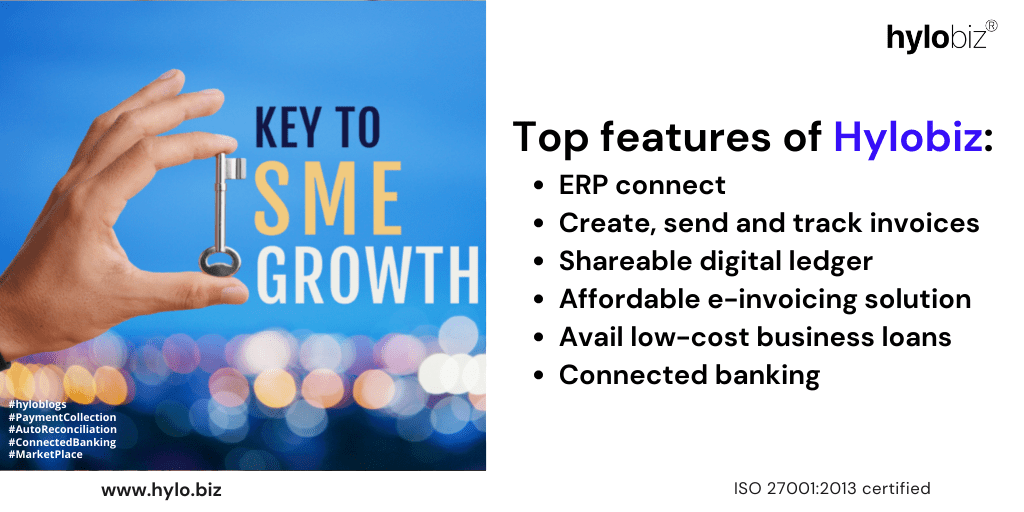

We at Hylobiz are helping businesses to become GST e invoicing compliant in the lowest possible time with top-class features.

With Hylobiz, you can start your invoicing journey without any process change or upload your invoices and get an e-invoice without any hassle.

Also, get other benefits with Hylobiz and grow your business with our all-in-one automation solution.

Some top features of Hylobiz are:

- Connect your existing ERP on Hylobiz in just a few clicks without any cost.

- Send/create a proforma invoice, sales invoice, and e-invoice with attached payment links and share them across social channels.

- Get a digital ledger for all your transactions with auto reconciliation directly into your ERP.

- Automate your collection with our pre-integrated payment gateway.

- Improve your relationship with suppliers by automating your payables.

- Track your business health on a real-time basis.

- Enjoy 360-degree control over your cashflows.

- Avail of business loans at lower rates.

Read more on our offerings: https://hylo.biz/offerings-sme/

Enjoy effortless business banking with top security

Avail of connected banking services with our banking partners on our ISO-certified platform. With connected banking, you can manage your payments and collection on the go at minimal costs with Hylobiz.

All your transactions on our platform are safe with multiple-layer encryptions.

Follow us on Medium: https://hylobiz.medium.com/

Hylobiz helps your business grow with its automation solution and reduces your operational costs by improving your overall business ROI.

Are you looking to improve your business efficiency?

Book a demo today: https://hylo.biz/book-demo/

Suggested read: https://hylo.biz/what-is-e-invoicing-under-gst/

Read more of our blogs: https://hylo.biz/blogs/

In case of any query, reach out to us: support@hylobiz.com

Frequently Ask Questions (FAQ)

Is an e-invoice required for B2B?

In India, the government has made e-invoicing mandatory for B2B transactions for businesses with a revenue ceiling of Rs 10 crore as of 1st October 2022. This means that businesses falling under this category must generate and issue electronic invoices, which will be authenticated by the government e-invoicing portal. This requirement is part of the government’s efforts to digitize the tax system, improve compliance, and reduce tax evasion.

Who is exempted from e-invoicing

In India, certain categories of taxpayers are exempt from e invoicing, including insurance companies, banking companies, financial institutions, non-banking financial companies, goods transport agencies transporting goods by road, transport service providers, and registered persons providing admission services for cinema exhibitions in multiplex screens. These exemptions are based on the nature of their businesses and the types of transactions they engage in. However, they are still required to comply with other GST regulations and maintain proper records of their transactions.

Why is e-invoice important?

E-invoicing offers several benefits, including a streamlined invoicing process, reduced fraud and errors, and the elimination of tax evasion. It can also result in faster input tax credit (ITC) claims and generate e-way bills. By automating the invoicing process, businesses can reduce the risk of errors, improve compliance, and save time and money. Additionally, e invoicing can provide greater visibility into business operations, enhance security, and improve cash flow.

What are the advantages of using e-invoice software or automated e-invoicing solutions?

Hylobiz offers automated e-invoicing solutions that provide businesses with increased efficiency, faster payment processing, improved accuracy, cost savings, and enhanced security. By automating invoicing tasks and streamlining payment processing, Hylobiz e invoicing platform can help businesses save time and money while reducing errors and improving security.

How e-invoicing under GST will help businesses in the long run?

E-invoicing under GST can help businesses in the long run by increasing efficiency, reducing errors, and improving compliance. With e invoicing, businesses can automate the invoicing process and ensure that their invoices comply with GST regulations. This can help businesses avoid penalties and improve their overall financial management. Additionally, e invoicing can improve cash flow, reduce processing time, and provide better insights into business operations.