Enabling Businesses to Grow Faster via Automated B2B Collections, Payments, and Working Capital with ZERO Process Change for the Business Owners.

In February 2022, Hylobiz celebrated its 3rd birthday.

Hylobiz serves businesses of all sizes in India and the UAE and is about to launch in the US.

We are excited about our progress so far and want to speak our heart out to let you know how this young fintech originated and about its roller-coaster journey so far.

And here it goes…

The Initial Days of Hylobiz

Like many other startups, we had a humble start.

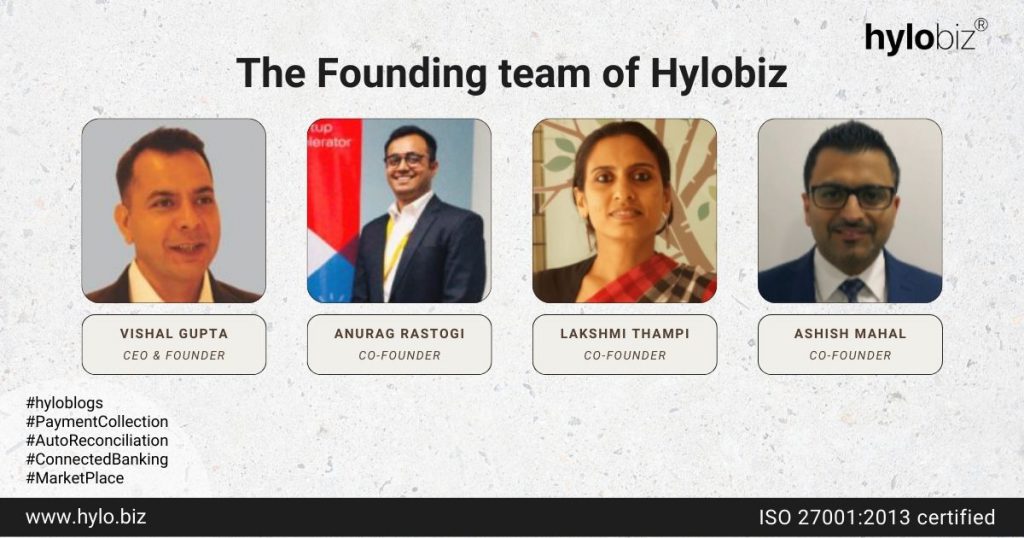

With a mission to solve the pain points of businesses, the founding team of Hylobiz presented their brainchild to the business segment of India in 2019. However, the growth path of Hylobiz was not very smooth.

A flashback… images, and events from the past take the front seats… few brains, limited resources, undefined workspace, unpredictable moments, switching emotions, big goals, and a strong belief!

To see the years before inception, survive in the market since the official launch, withstand instability and failures, and achieve every bit of success till today, took years of perseverance, togetherness, and hard work of a committed team that grew slowly over the years guided by the vision and mission laid down by the four experienced co-founders.

The Story Behind the Birth of Hylobiz

Hylobiz since the period of ideation was unique in its approach compared to the existing players. We started as a “ZERO PROCESS CHANGE” collections and payouts automation solution for businesses in the B2B segment.

In 2018, our CEO Vishal Gupta noticed that every SME-focused fintech aimed at providing working capital to businesses. Vishal and our other cofounders, Lakshmi Thampi, Ashish Mahal, and Anurag Rastogi looked at the opportunity in a different and innovative way.

They wanted to offer an automation business banking platform to B2B businesses without disturbing their existing workflows.

Instead of offering the capital straight away (to avoid challenges of finding the customer, their credit rating, NPAs, collections, etc) for the capital shortfall a business has, the masterminds of Hylobiz thought of offering an automation solution to optimize the business cashflows first.

With the understanding of the nature of the client’s business, then the vision remained to deliver other financial services like credit, capital, insurance, taxation, compliance, banking, etc on the financial service marketplace to serve the needs specific to the business.

Since 2012, the founding team of Hylobiz is in close association with Open banking automation solutions in India, the Middle East, and Southeast Asia.

SMEs often operate with limited resources and find it difficult to adapt and manage technology. On the other hand, they need to work with multiple users, accounts, and ERPs which are mostly handled manually. Financial institutions get no clue about their cash position and often deny credits.

The founders of Hylobiz felt the need for a digital business automation solution to solve business needs and founded Hylobiz to help businesses with seamless business banking and enable them to connect with financial institutions easily.

Journey of Hylobiz Since 2019- a Glance

Following its first step in India in 2019, Hylobiz launched in UAE, immediately the next year, in September 2020.

By 2022, Hylobiz became VISA-ready certified as a part of the Fintech partner connect program. We are an ISO-certified business providing top-notch security to SME businesses. With 3000 plus Sellers and 150,000 buyers connected via hylobiz for their cash management, Hylobiz now works with Vayana Network’s capabilities on enabling working capital for the supply chain networks.

Hylobiz is already integrated with all popular ERPs like Quickbooks, Tally, and ZOHO. We are in partnership with top financial institutions to offer credits and with Kotak Mahindra Bank, Yes Bank, and Axis Bank for connected banking services in India. Hylobiz helps partner banks to support open API capabilities.

Today Hylobiz is not just restricted to payment collections, automated reconciliations, cash flow tracking, and vendor payouts.

We keep updating the platform. Our e invoicing solution is powered by Vayana GSP. We also support e-way bill compliance.

INC 42 has recently listed us as one of the 25 startups to watch out for in 2022. We are featured on Product Hunt.

We were featured on multiple media channels at varied times and on different occasions.

Read here: https://hylo.biz/press-release/

Our First Customers, Our Well-Wishers, Our Customers Today – We Love to Speak About Them

Hylobiz’s first set of customers were two Bangalore-based distributors of CEAT tires. We did not have to wait much to get a chance to work with CEAT headquarters. Since then, we saw steady growth.

A Brief on Hylobiz Business Automation Solution

For those who are yet to explore our platform and are keen to know about our key offerings, Hylobiz is a young fintech serving businesses in the B2B space and offers connected ERP and connected banking services to facilitate digital payment collections, auto reconciliations automation, facilitates access to credits, automates cash flow, and a lot more. Our solutions are suitable for any business – manufacturer, distributor, dealer, trader, wholesaler, importer/exporter, or entrepreneur across industries. sign up now

We are a neobank bridging financial services and simplifying business banking. Our stats say, that businesses can see a 40% improvement in collections and working capital efficiencies once they start using the Hylobiz platform.

We help businesses to automate system functions efficiently and effectively through real-time updates on their business health and cash flows.

Read our blogs: https://hylo.biz/blogs/

Email us at: support@hylobiz.com