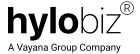

E invoicing under GST became mandatory for businesses having an aggregate turnover of more than Rs.500 crore in a financial year effective from 1st October 2020.

Later it became applicable to taxpayers having a turnover of more than Rs.100 crore effective from 1st January 2021.

From 1st April 2021, it applies to businesses whose turnover is more than Rs.50 crores in the last financial year.

The government has extended Electronic Invoicing for taxpayers with a turnover of more than Rs20 crores effective from 1st April 2022.

What is E invoicing?

E invoicing under GST is commonly known as electronic invoicing. In GST e-Invoicing, the seller uploads the invoice to the Invoice registration portal(IRP) and after proper validation, gets an Invoice registration number(IRN) with a QR code.

What are the benefits of e-invoicing?

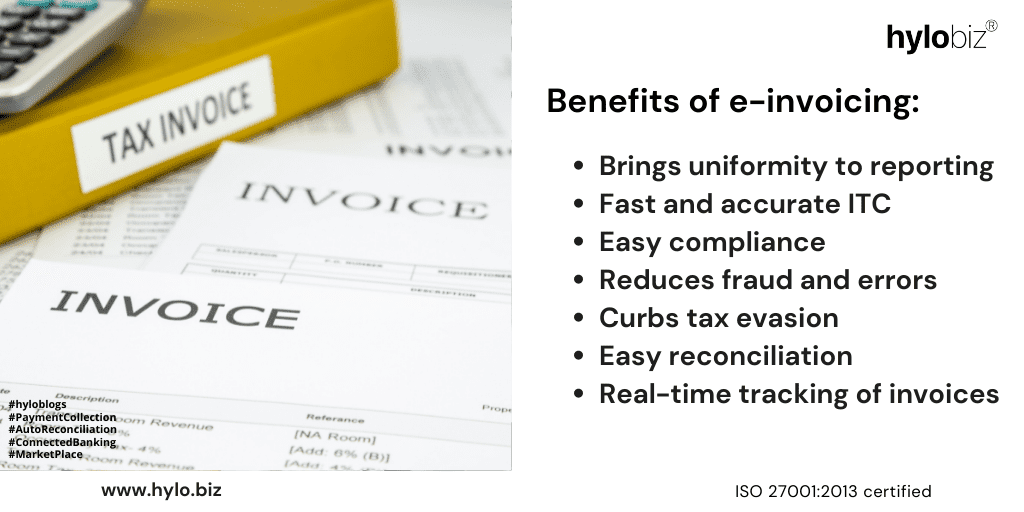

E invoicing under GST is Beneficial for Businesses Because of Many Reasons:

- Brings uniformity:

Electronic Invoicing brings uniformity to the business processes and makes business Invoicing compliant under GST. It also eliminates the requirement of reporting invoices in multiple formats. - Input tax credit:

It hastens the ITC claim for businesses as IRN is available on the GSTN portal. So matching ITC claims will be easier and faster. - Easy compliance:

It becomes easy for the businessman to file returns and generate e-way bills with the auto-populated data. - Reduces fraud and errors:

With electronic invoicing, the same data is reported to all the involved parties and is available to everyone, including GSTN. So, it eliminates any chances of fraud or fake invoices. - Reduces tax evasion:

Before carrying out the transaction, a seller needs to generate the invoice on the portal. So timely reporting of the transactions reduces the chance of any tax evasion. - Easy reconciliation:

It allows interoperability between different systems, so it helps in easy data reconciliation and reduces manual errors. - Real-time tracking of invoices:

It also enables easy and real-time tracking of invoices as every data is available with the GSTN portal.

Why Should Hylobiz Be Your Preferred Go-to Partner for E invoicing under GST?

Hylobiz enables GST Invoicing on its platform to help businesses become invoicing compliant under GST.

We help you automate your accounts receivables, payables, and business finances through our ERP connect and connected banking services.

Onboard on Hylobiz today and enjoy best in class Electronic Invoicing solution with top-class banking features.

Sign Up Here: https://hylo.biz/book-demo/

Let’s discuss the benefits of using Hylobiz as your e-invoicing partner:

- Easy, Quick, and Reliable.

You can easily create your E invoicing under GST on Hylobiz in a few clicks and enjoy zero-second downtime with the Hylobiz invoicing solution powered by Vayana GSP. - Easy Integration with the Lowest Set-Up Time.

Easily integrate your existing ERP or invoicing software on Hylobiz in a few clicks and start generating your e-invoice in a flash. Otherwise, upload your invoice on our platform and get your IRN(e-invoice). - Auto Reconciliation.

Enjoy auto-reconciliation into your ERP, invoices, and bank account with Hyobiz. It also saves your accountant time from manual reconciliation. - Digital Ledger.

We understand the value of business relationships, so we offer a digital ledger of all your transactions that supports real-time updates.

Also, the Hylobiz ledger is shareable with the buyer or supplier. - Smart Dashboard.

Our dashboard features help businesses with informed decision-making, as it allows them real-time access to their business health, cash flows, insights into their expenses, and various business reports. - 360-Degree Customer Support.

We offer round-the-clock support to our customers from our technical and domain experts.

Hylobiz’s Other Top Features:

- Automation of Receivables and Payables.

We help businesses in improving their collection efficiency by automating their account receivables. You can also automate your payables and payment reminders with us. - ERP Integration.

We support all the leading ERPs on our platform and offer easy integration at zero cost. Also, improve your business efficiency with us without any process change. - Pre-Integrated Payment Gateway.

Hylobiz comes with a pre-integrated payment gateway that allows your customers to pay you using multiple modes. It helps in improving customer experience and faster collection of receivables. - Inventory Management.

Manage your inventory digitally on your platform and optimize your inventory handling costs. Also, receive a notification when a stock item is running low. - Avail of Business Loans.

We support businesses in their growth journey and capital requirements. So, we offer easy and quick business loans at lower rates with our partners like Bajaj Finserv and Neogrowth Credit Private Limited.

Read More on the Benefits of Business Loans: https://bit.ly/businessloansbenefits

Follow us on Medium: https://medium.com/@hylobiz - Connected Banking.

Now, solve your business collection and payments in a breeze with our connected banking services. Connect your existing bank account on our platform and enjoy hassle-free connected banking services at low transactional costs.

Currently, we support connected banking services for Kotak Mahindra Bank and YES Bank customers.

Visit our SME offerings page: https://hylo.biz/offerings-sme/ - Transparent pricing.

We say no to hidden fees. We charge you a very nominal fee on a transactional cost basis.

Your safety is our Priority

We take your privacy very seriously and maintain bank-grade security on our systems. Hylobiz is an ISO-certified platform that applies multiple encryptions and two-factor authentication to your transactions to make them safe and secure.

If your business is having turnover of more than Rs. 20 crores, you’re looking for reliable software to generate E invoicing under GST portal.

Come onboard on Hylobiz today and get free 100 credits. You can redeem your credits to generate 100 e-invoices for free.

Hylobiz helps businesses to improve their business processes and drives efficiency with cost reduction.

Read more: https://hylo.biz/how-do-neobanks-in-india-works/

Visit our blogs: https://hylo.biz/blogs/

Reach us at: support@hylobiz.com

Frequently Ask Questions (FAQ’s)

Why is e-invoicing needed?

E invoicing is needed to streamline payment processes, reduce errors, save time and cost, enhance compliance, and improve cash flow management.

How do I create an e-invoice bill?

To create an e-invoice bill, you can use a dedicated software solution or online platform like Hylobiz that allows you to generate and send electronic invoices in a standard format.

What happens if e invoicing under GST non-issuance?

Non-issuance of e invoicing under GST can lead to penalties, delays in payment, and non-compliance with tax regulations.

Do I need e-invoicing for my small business?

Yes, if your turnover is more than 10 crores, as of 1st October 2022

Will there be a facility to generate e-Invoicing on the common GST portal?

Yes, the common E invoicing under GST portal in India provides a facility to generate e-Invoicing