Poor cash flow cycles, manual invoicing, and very long turnaround times for collections are the primary struggles of any business for banks,especially small businesses across the globe.

Understaffed teams and a lack of enough capital and technical support, make their situations more miserable.

Cash is the king and there are demands for solutions that make business banking smooth and cash flow automated.

Generating cash from blocked invoices and automating cash collection are the keys to any business’ working capital management.

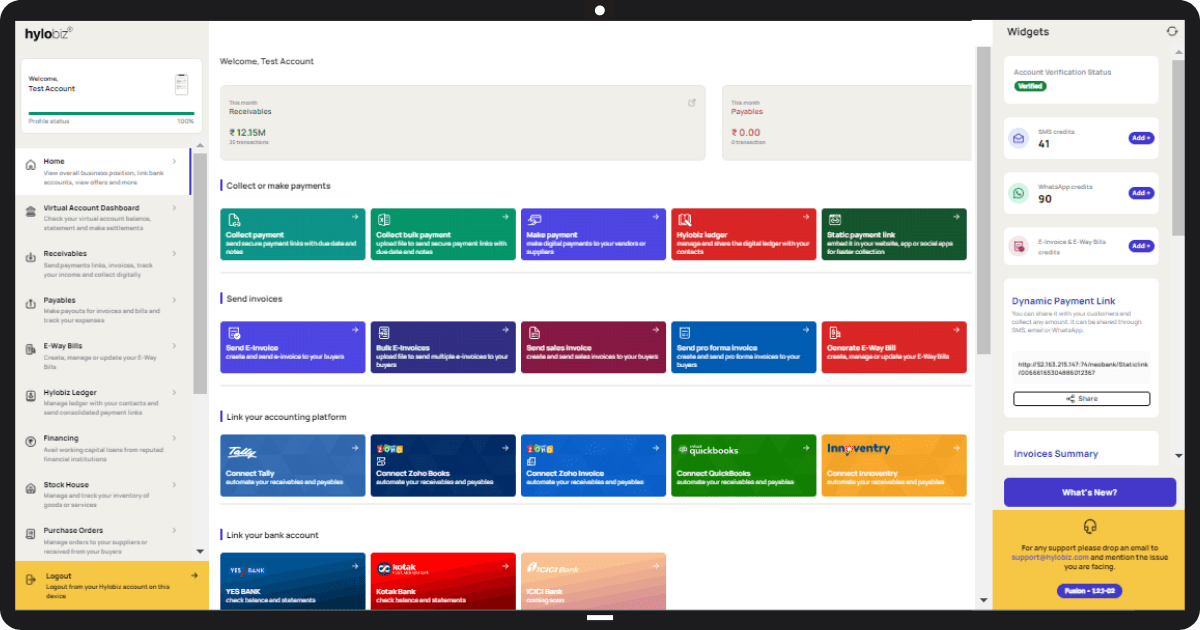

Hylobiz is an ISO-certified fintech digitizing the entire value chain and automating essential business processes involving invoicing, collections, reconciliations, and more.

A registered business can easily integrate bank accounts and ERPs with the platform and get access to services that can save cost, effort, and time.

Hylobiz serves the B2B segment in India and UAE and is ready to launch in the US market.

We had a chance to discuss with Jayashree (Founding Member of Hylobiz – Head MEA & Strategic Partnerships) regarding business banking,

our collaborations with bank or financial institutions, and her perspectives on the same.

Her replies were insightful, and here is what we discussed.

What are the Changes you have Witnessed in Business Banking Post-Pandemic?

Jayashree: Small and medium-sized enterprises (SMEs) are the backbone of the GCC economy. This accounts for over 90 percent of all businesses and provides a major source of new job creation.

Government and Central Bank recognize the important role that SMEs play in contributing to GDP. SME development has been placed as a key area of focus in these countries.

SMEs have taken the hardest hit during the COVID-19 pandemic. According to a recent report, more than 60% of SMEs are changing their business model to drive profitability and sustain growth.

SMEs are digitizing rapidly and are open to new technologies and they expect their financial provider to adapt or support such changes.

Business banking plays a major role in the Middle East banking sector. This accounts for nearly 75 percent of total banking assets and gives almost 60 percent of total revenues*.

Customers expect the FIs to support strategic long-term advisory support more than traditional transactional or lending-based relationships.

Three major shifts are witnessed by the business banking teams of FIs. Firstly, the need to develop analytics capabilities that support understanding customer needs and behavior.

Secondly, the application of these digital initiatives to the mass segment of customers delivers seamless integration of banking services into clients’ businesses.

Thirdly, platforms and APIs enhance the capabilities of the bank to launch personalized services and allow them to tap into new revenue streams.

Please throw Some Light on the Banking or Financial Institution Collaborations that Hylobiz has.

Jayashree: Hylobiz is already connected with a top bank in India such as Axis Bank, Yes Bank, Kotak Bank, HDFC Bank, and other leading public and private sector banks.

In ME Hylobiz is in the process of launching with one of the leading Bank in UAE and in Oman.

Hylobiz is part of the Visa Fintech partner connect program for B2B payment digitization across CEMEA and India.

In UAE, Hylobiz offers a sub-version of collection automation through Etisalat UAE for the B2B segment. The platform already has c. 115k users covering India and UAE.

How are the Partnerships with Banks Helping You (Hylobiz), Bank, and Your Customers?

Jayashree: Hylobiz supports its banking partners to enable them to help businesses manage their cashflows better and digitize their collections or payments via connected ERP or Accounting platforms and connected banking.

Customer engagement is not restricted to traditional Internet or Mobile banking offering, but with Banking partners, Hylobiz enables real-time access to finance.

FI partners have the opportunity to capture a higher wallet share of customers by syncing Banking with the entire receivables and payables of their customers.

These are seamlessly connected via APIs without any additional investment in resources or technology. The use cases are different with every bank,

based on the existing ecosystem and to complement the ongoing process and technology.

The range of product offerings to FIs are the end-to-end white labeled solutions, connected banking with current account and linking receivable or payable, e-Invoicing, reconciliation, inventory management,

network sales visibility, good business score, digital storefront, real-time data visibility, pre-integrated ERP (c.30 ERPs by this quarter),

real-time document and workflow visibility along with many other upcoming features of the platform.

Hylobiz helps partner banks to support open API capabilities and automatically offer futuristic B2B financial services ahead of the market. It’s a single solution that caters to all B2B financial offerings.

The Bank benefits by offering solutions that attract new customers, and gain higher wallet share, transactional revenue, and incremental fee income.

Seamlessly able to connect to thousands of ledger books, and offer financing on a real-time basis.

For the customers of the Bank, this is a ‘plug-and-play platform or mobile application. Currently, they face challenges with multiple fragmented processes i.e., accounting platform, Banking transactional platform,

Separate mundane collection, and reconciliation process.

With Hylobiz ERP, Receivable, payable, reconciliation, and connected banking are integrated to provide a real-time view of business health status that allows working capital efficiency which is the backbone of any business.

Are you Facing any Challenges?

Jayashree: Hylobiz is not a traditional software or solution that is provided for the partner banks to continue to manage on their own.

We follow a partnership model to understand the existing offerings of the bank or corporate and then decide on use cases that will be beneficial to the partner.

This exploratory stage sometimes takes longer than expected. However, the end objective is to benefit the FI on a long-term basis.

The product and technology will be managed by the Hylobiz team to work with the partner to support commercialization.

The solution also works on an OPEX model to facilitate the partner bank’s scaleup with the launch of new use cases.

What is Your Strategy/Plan for this Going Forward?

Jayashree: Over the past three years the product and the concept have been validated and endorsed by various local and international partners.

The recent group-level synergy with Vayana Network has opened up new opportunities to cover the entire B2B funnel ranging from MSMEs to large corporates to FIs.

The plan is for Hylobiz to go live with 3 new markets (USA, Indonesia, and Oman) this year, apart from the existing operational India and UAE.

The use cases are not just B2B space on payments but include supply chain finance, extended SME finance, Vendor finance, Invoice discounting, and Commercial card products linking the end user and banking partner.

How do you Differentiate Hylobiz from the Other Similar Platforms that also Offer Connected Banking?

Jayashree: There are multiple standalone platforms that offer invoice discounting, Automated reminders, reconciliation, payment gateway, etc.,

The biggest differentiator with Hylobiz is a single ecosystem that covers an end-to-end B2B digital financial suite covering the business owner, the business, accounting platform, and banking platform.

The API economy can bring significant revenue streams. APIs allow banks to charge for services that they offer through Open Banking or can be leveraged to cut costs, up-sell or cross-sell.

To succeed in Open Banking, FIs should start thinking like platform companies, flexing their business models to connect businesses and backing that up with technology infrastructure that can manage interactions between internal and external users.

Hylobiz, as mentioned above, is a Neo banking solution that supports businesses, banking partners, and everyone in the B2B ecosystem, which by nature is highly complex and regulated.

[*Middle East Central Banks data; published financial statements of commercial banks.]

Hylobiz Features and Benefits- opening doors to newer opportunities:

- ERP and account integration

- Automated invoicing and collections

- Integrated payment gateway

- Payment links and automated payment reminders

- Single or bulk vendor payouts

- Quick settlement and Auto reconciliation

- e-Invoicing and e-Way bill compliance

- Shareable digital ledger

- Smart dashboard and automated reports

- Top-notch security

- Support from domain experts

| Read to know about our recent product updates: https://hylo.biz/hylobiz-product-update/ |

| Read our blogs: https://hylo.biz/blogs/ |

We are in a continuous strive to bridge financial services. We are redefining business banking and are on a mission to build a well-knit B2B value chain. If you are yet to digitize your business, do sign up now.

We would like to hear from you.

Reach out at support@hylo.biz.