Staying ahead of the competition is essential in the contemporary marketplace. Every minute is valuable, and you cannot afford to squander time manually processing invoices, reconciling and tracking cash flow.

An advanced fintech like Hylobiz can help businesses to explore possibilities such as productivity, growth, cost reduction, innovation, and risk management.

What are the Problems Faced by B2B Businesses?

- B2B businesses often have to deal with longer payment terms and delayed payments from clients, which can create cash flow problems.

- Traditional payment methods such as checks, and wire transfers may be time-consuming and error-prone.

- B2B Businesses must handle credit, fraud, and non-payment risks.

- Business to Businesses may have trouble obtaining working capital loans from traditional financial institutions.

- They struggle to stay in compliance with the laws and regulations and spend a lot of time managing them.

- B2B businesses find it difficult to stay up to date with the latest technology trends, remain competitive and meet customer expectations.

- As Business-to-Business grow, they may struggle to scale their operations and processes to keep up with demand.

How can a Fintech Service help B2B Businesses?

Fintech has transformed the way businesses handle their finances by disrupting traditional banking and financial services. The development of fintech services has benefited businesses of all sizes, particularly B2B firms.

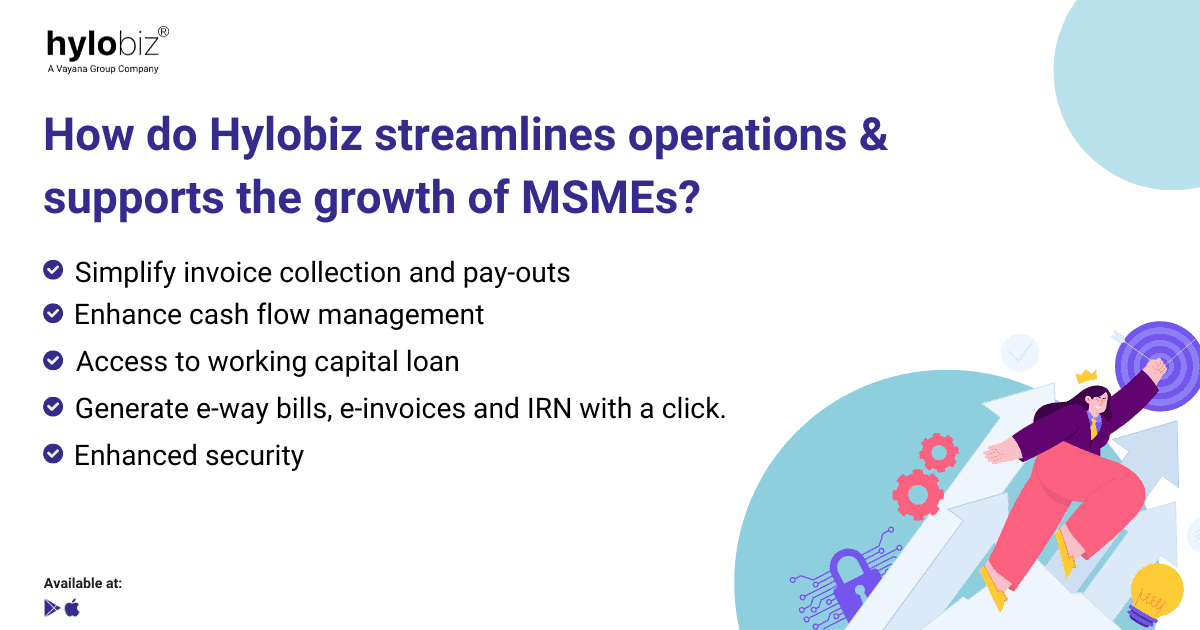

How does Hylobiz Streamlines Operations and Support the Growth of MSMEs?

1. Simplify Invoice Collection and Pay-outs

Faster payment collection and automated payouts are the key advantages of using fintech services for B2B firms. Fintech firms offer digital payment solutions that simplify the payment process, making it easier and faster for businesses to pay and get paid.

With Hylobiz,

- You can digitalise invoices and reduce errors in the billing process. Send out payment links, QR codes and automated reminders for collecting payments faster.

- You can send payments to suppliers and vendors, saving time and decreasing the risk of errors associated with traditional payment methods

2. Enhance Cash Flow Management

Fintech services like Hylobiz can also assist B2B companies in better managing their cash flow. Businesses can monitor their cash flow and make informed decisions regarding spending and investments by using real-time data.

Fintech tools can enable businesses to analyse spending, estimate cash flow, and identify potential financial concerns.

Hylobiz allows you to:

- View the status of invoice transactions and send out reminders for pending bills. Nudge your customer through customised payment reminders. Set the time, frequency and date as per your needs.

3. Access to Working Capital Loan

Small businesses sometimes don’t have an adequate amount of cash or liquid fund for their day-to-day operations. This makes them look for working capital loans. MSMEs are unable to obtain loans since they do not have valuable assets to pledge.

Fintech companies like Hylobiz use advanced technology to assess business creditworthiness, enabling financial institutions to provide loans faster and more efficiently.

Hylobiz customers can

- Track transactions and unpaid invoices/bills in real-time with the smart dashboard, automated reports and digital ledger, to get access to easy collateral-free working capital loans from any financial institution.

4. Generate e-Way Bills, e-Invoices and IRN Within a Click.

Adhering to GST compliance is a hassle for MSMEs.

Hylobiz is Powered by Vayana GSP and allows you to.

- Import invoices from ERP to produce e-invoices.

- Create e-way bills from e-invoices.

- Share e-invoices with payment links and QR codes via WhatsApp/SMS/E-Mail for faster collection.

5. Enhanced Security

Lastly, fintech services like Hylobiz offer enhanced security measures that protect businesses against fraud and cyber threats.

Transact safely with Hylobiz.

- Data encryption and multi-factor authentication, protect your business.

Hylobiz helps businesses streamline processes, increase profitability, and save expenses.

We provide easy ERP integration and seamless connection with your bank accounts. This enables you to benefit from Hylobiz’s specialised automated solutions for invoicing and e-invoicing, collection, payables, and reconciliation.

The all-in-one automated solution can also help your company’s cash flow. With Hylobiz, there is no chance of stockpiling and the expenses are controlled to maintain the stock. Through our dashboard, we let you get complete control over your company’s status, cash flow, and costs.

With Hylobiz, overcome the challenges and hurdles in the business processes and manage operations effectively.

Register now and avail all that Hylobiz has to offer!

Know more on Hylobiz: https://hylo.biz/

Read more of our blogs: https://hylo.biz/blogs/

Reach us: support@hylobiz.com

Frequently Asked Questions

Is FinTech Better than Bank for B2B Business?

1. Many Fintechs have created digital apps that act as a single hub for all current goods and services, as well as a virtual marketplace.

2. Fintechs have the benefit of providing quicker loan decisions, better customer service, reduced costs, and a more secure risk profile

What are the Advantages of FinTech Companies for B2B Businesses?

1. Increase in access to working capital.

2. Financial services at your fingertips.

3. Save cost and time.

4. Focus on important areas such as growth and operations

What Business-to-Business Problems Does Fintech Solve?

1. Payment processing.

2. Cash flow management.

3. Financing.

4. Compliance issues.

5. Risk management.

Why Fintech is the Future for B2B Business?

Fintech has provided the digital revolution of the financial services industry, allowing B2B businesses to provide faster, more efficient, and cost-effective services. It has the ability to simplify financial procedures, provide more flexible financing alternatives, real-time data and analytics, increased security, global reach, and customized services.